Ethereum in the spell of uncertainty: Wal activity increases, but the bear-like pressure remains strong

Ethereum (ETH) of challenges: A look at the market at the beginning of the week Ethereum (Eth) shows a certain uncertainty, while the bearish trend weakens. Market participants point their attention to the upcoming pay decision on the so -called "liberation day", since this could have a significant impact on risk systems such as cryptocurrencies. BBTRend indicator and market mood currently remains the BBTREND indicator for Ethereum negative at -11.66, which is a slight improvement compared to the previous day (-12.54), but remains the second day in a very negative area. The Bollinger Band Trend (BBTREND) measures the strength and direction of a trend by the interaction of the price with the upper ...

<p> <strong> Ethereum in the spell of uncertainty: Wal activity increases, but the bear-like pressure remains strong </strong> </p>

Ethereum (ETH) with challenges: A look at the market

At the beginning of the week, Ethereum (ETH) shows a certain uncertainty, while the Bärische trend weakens. Market participants point their attention to the upcoming pay decision on the so -called “liberation day”, since this could have a significant impact on risk systems such as cryptocurrencies.

BBtrend indicator and market mood

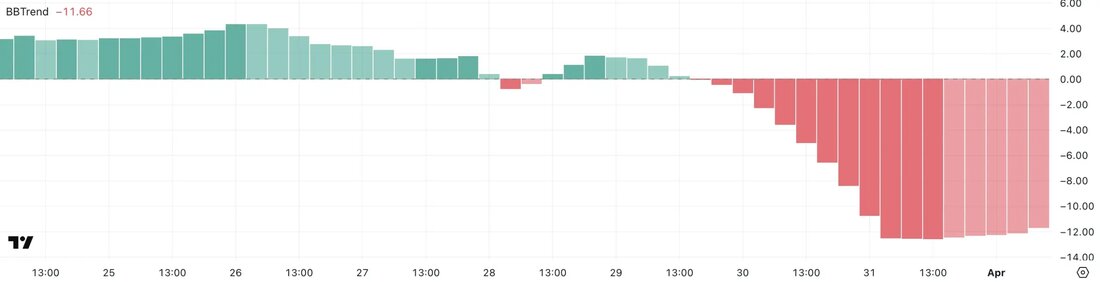

Currently the BBTREND indicator for Ethereum remains negative at -11.66, which is a slight improvement compared to the previous day (-12.54), but remains the second day in a very negative area. The Bollinger Band Trend (BBTtrend) measures the strength and direction of a trend by analyzing the interaction of the price with the upper and lower Bollinger ligaments.

- Positive Bbtrend : Bullisches Momentum (course moves towards the upper band)

- negative BBTtrend : Bärische Momentum (course tends to the lower volume)

A value over 10 (or below -10) is considered a strong trend signal, which means that the current value of -11.66 indicates ongoing sales pressure. Although the recent increase in a possible slowdown of down momentum indicates, the indicator is still below the neutral zone, which means that the bears keep control for the time being.

Wal activity in the Ethereum network

In the last 24 hours, the number of Ethereum whales-Wallets with 1,000 to 10,000 ETH-has increased from 5,322 to 5,330. This number is crucial for market observers, since large owners often specify the trend. The accumulation of whales indicates growing trust in the medium -term development of Ethereum, especially in consolidation phases. However, the current number of whales remains under previous maximum values, which indicates that some whales get in again, while the wider cohort has not yet fully positioned.

A persistent increase in this key figure could have a positive effect on the market mood and the Ethereum course. At the moment, however, a cautious optimism predominates.

potential for a course outbreak over $ 2,100?

The EMA lines (exponential sliding average) from Ethereum show the first bullish signals. The ETH course tries to break short-term moving average. A breakthrough of the resistance at $ 1,938 could initiate a recovery, with the next goals:

- 2.104 USD (resistance 1)

- 2.320 USD (resistance 2)

- 2.546 USD (potential goal in strong momentum)

, however, if Ethereum fails due to this resistance, the focus could be on the support areas again:

- 1.823 USD (important support)

- 1.759 USD (next downward goal at Bruch)

FAZIT

Ethereum shows delicate signs of soil formation, but the market remains fragile. The BBTREND indicator and the Wal data signal carefully hope, but it remains to be seen whether this is sufficient for a sustainable outbreak. Market participants should remain attentive and follow the developments closely.

Suche

Suche

Mein Konto

Mein Konto