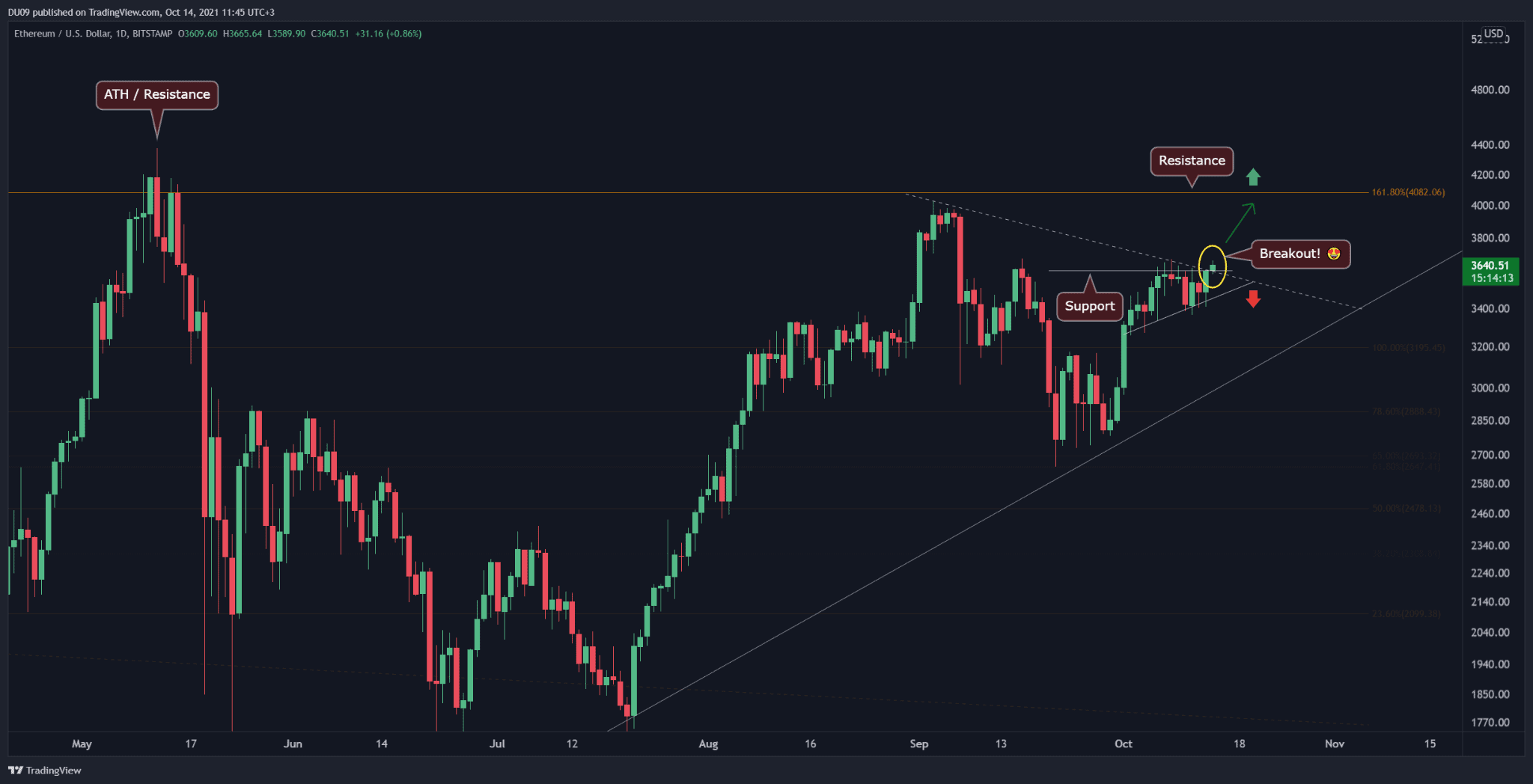

Ethereum price analysis: Are $ 4,000 for ETH after breaking through an important resistance?

Key support levels: $ 3,600 key resistance: $ 4,000 Ethereum (ETH) broke the key resistance at $ 3,600 and successfully converted it into support in the 4-hour time frame. With this outbreak, cryptocurrency has a clear way to test the all -time high of $ 4,380 again. The ATH will act as a resistance until it is broken, and therefore profit treatment can be expected as soon as we reach a price of $ 4,000. This can lead to a correction until ETH successfully breaks through the key resistance and enters the pricing again. Chart after tradingView indicators volume: The breakout volume in the 4-hour time frame was strong. However, we need continuation and ...

Ethereum price analysis: Are $ 4,000 for ETH after breaking through an important resistance?

key support levels: $ 3,600

key resistance level: $ 4,000

Ethereum (ETH) broke the key resistance at $ 3,600 and successfully converted it into support in the 4-hour time frame. With this outbreak, the cryptocurrency has a clear way to test the all -time high of $ 4,380 again.

The ATH will act as a resistance until it is broken, and therefore profit -taking can be expected as soon as we reach a price of $ 4,000. This can lead to a correction until ETH successfully breaks through the key resistance and enters the pricing again.

Chart according to tradingview

Chart according to tradingview

indicators

volume: The breakout volume in the 4-hour time frame was strong. However, we need a sequel and more volume to maintain the upward trend.

rsi: The RSI on daily and 4-hour time frame is moving higher as expected. As soon as the RSI reaches a higher high in the daily time frame, trust in this upward trend will increase.

macd: The latest interest bullic cross of the sliding MacD average in the 4-hour time frame is a great indicator that the price will continue to rise. In the daily time frame, things remain optimistic and in the expectation of a new rally.

bias

The general tendency is bullish, especially if the price remains over $ 3,600. With more volume and adding buyers, the ETH can push further up and approach the ATH. This tendency will only change if the price falls below $ 3,400. At that time the current outbreak would be confirmed as a fake.

Short -term price forecast for ETH:

With the ATH within reach, ETH seems ready to test the key resistance again at $ 4,000. Once there, the price could consolidate in a narrow area, since no significant pushbacks can be expected. Finally, the ETH can free itself from the current resistance and enter the pricing. As soon as this happens, further climbs will be very likely in the near future as long as the overall market remains bullish.

The above analysis was written by du09 .

.

Suche

Suche

Mein Konto

Mein Konto

Chart to Tradingview

Chart to Tradingview