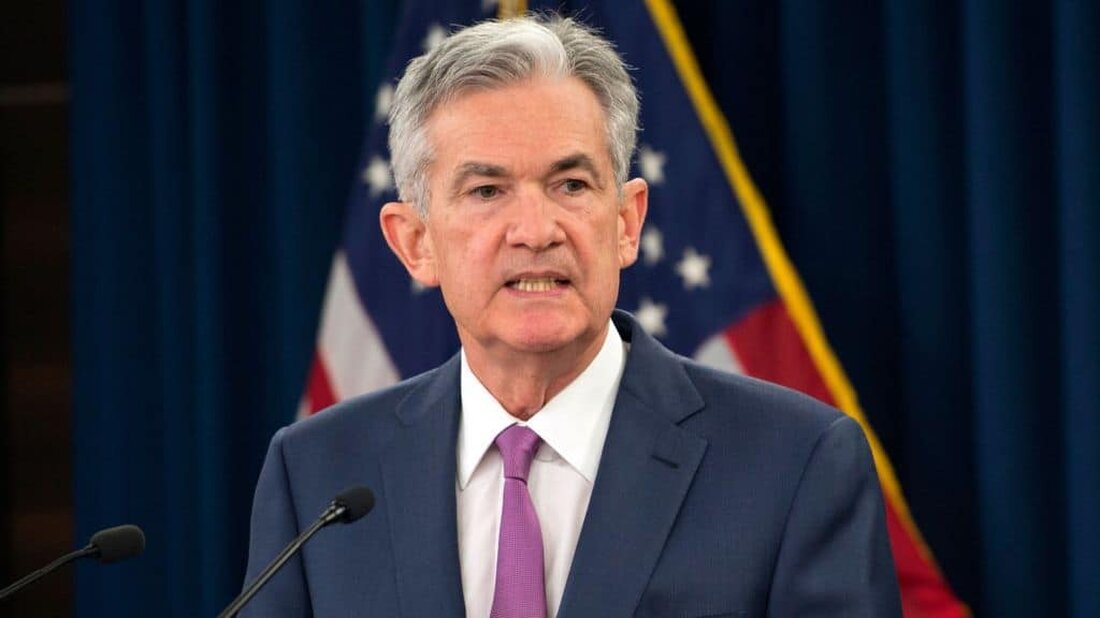

The FED increases interest rates by 25 points, which leads to Bitcoin volatility

Despite fears around the US banking sector, the FED has continued its plans to dampen inflation with an interest rate increase by 25 basis points on Wednesday. The decision was particularly important to the Bitcoin price, which was pumped up for $ 300 within 5 minutes after the announcement. Bitcoin started the day trade at $ 28,216 before it rose to $ 28,417 before the FOMC. After the interest decision, the asset then rose to $ 28,752. It is traded for $ 28,480 at the time of writing. According to the Coinglass, there were liquidations of ...

The FED increases interest rates by 25 points, which leads to Bitcoin volatility

Despite fears around the US banking sector, the Fed has its plans to dampen inflation with an interest increase by 25 basis points on Wednesday.

The decision had a particularly important effect on the price of Bitcoin, which was pumped up for $ 300 within 5 minutes after the announcement.

- Bitcoin began the day trade at $ 28,216 before it rose to $ 28,417 before the FOMC.

- After the interest decision, the asset then rose to $ 28,752. It is traded for $ 28,480 at the time of writing.

- According to the Coinglass, there were liquidations of $ 19.64 million within the last 1 hour after the announcement.

- The decision increases the Fed's key interest rate to a range of 4.75 % to 5 %.

- The VPI inflation in February was 6 %, which the Fed tries to bring back to its target with high interest rates.

- The former Fed president of Richmond, Jeffrey Lacker claims To reach and that the economy still has scope for further tightening.

- The markets had expected the interest rate increase this month, although they had priced in a probability of 16 % that there would be no interest rate increase.

- some believed that the Federal Reserve could shy away in the face of numerous reserve bank failures this month, partly caused by breaking in from Bond prices that were spurred on by rising interest rates.

- However, others claim that the Fed has enacted a "pivot" by its bank.

- "The committee assumes that an additional tightening of politics could be appropriate to achieve a monetary policy that is sufficiently restrictive to trigger inflation over time to 2 percent." specified The central bank.

.

Suche

Suche