Bitcoin will increase much higher according to Novograms, here is the reason

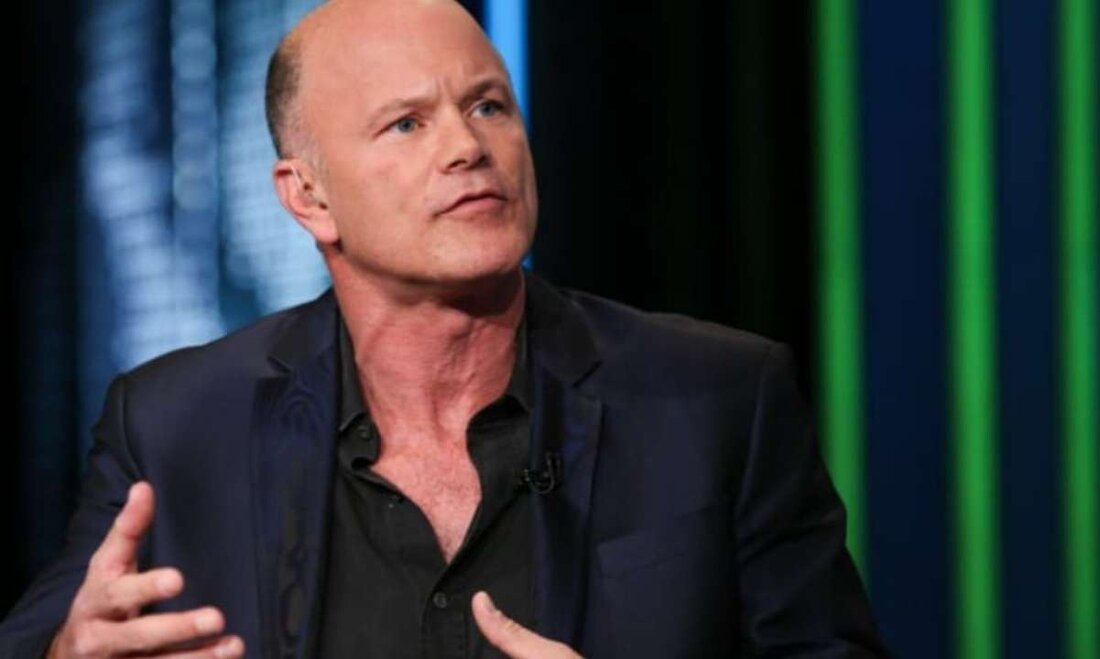

Mike Novogratz - the CEO of Galaxy Digital - said that China's less hostile attitude towards the crypto industry could be a reason for Bitcoin's possible price increase in the next few months. The Hong Kong subsidiaries of some leading Chinese banks have recently offered their services to local cryptocurrency companies. The bullish forecast of Novogratz The American investor believes certain factors could trigger another price rally for the cryptocurrency market. On the one hand, he argued that "all the necessary sales were made". Remember that the countless negative events in the industry in the past year, including the Terra crash, the 3AC bankruptcy and the FTX nucleus melts hindered the interest of ...

Bitcoin will increase much higher according to Novograms, here is the reason

Mike Novogratz-the CEO of Galaxy Digital-said that China's less hostile attitude towards the crypto industry could be a reason for Bitcoin's possible price increase in the coming months.

The Hong Kong subsidiaries of some leading Chinese banks recently offered their services to local cryptocurrency companies.

Suche

Suche

Mein Konto

Mein Konto