Bitcoin fell below $ 22,000, but bulls may prepare another thrust upwards (BTC price analysis)

Bitcoin's latest rally has improved the general mood among the market participants. This change of scene has triggered a positive dynamic in the entire industry because signs of a bull market begin to burst. Technical analysis of Shayan The Tartar The Price Region of $ 25,000 has been the most important obstacle on the way of Bitcoin in the past eight months. Finally, the course tried to exceed this level and failed what led to a consolidation correction phase. After an impulsive increase, however, a correction phase for the continuation of the rally is essential, which is normally simultaneously formed with the formation of the pullbacks. Therefore, the recent slump ...

Bitcoin fell below $ 22,000, but bulls may prepare another thrust upwards (BTC price analysis)

The latest rally from Bitcoin has improved the general mood among the market participants. This change of scene triggered a positive dynamic in the entire industry because signs of a bull market begin to burst.

technical analysis

of Shayan

the daily -type

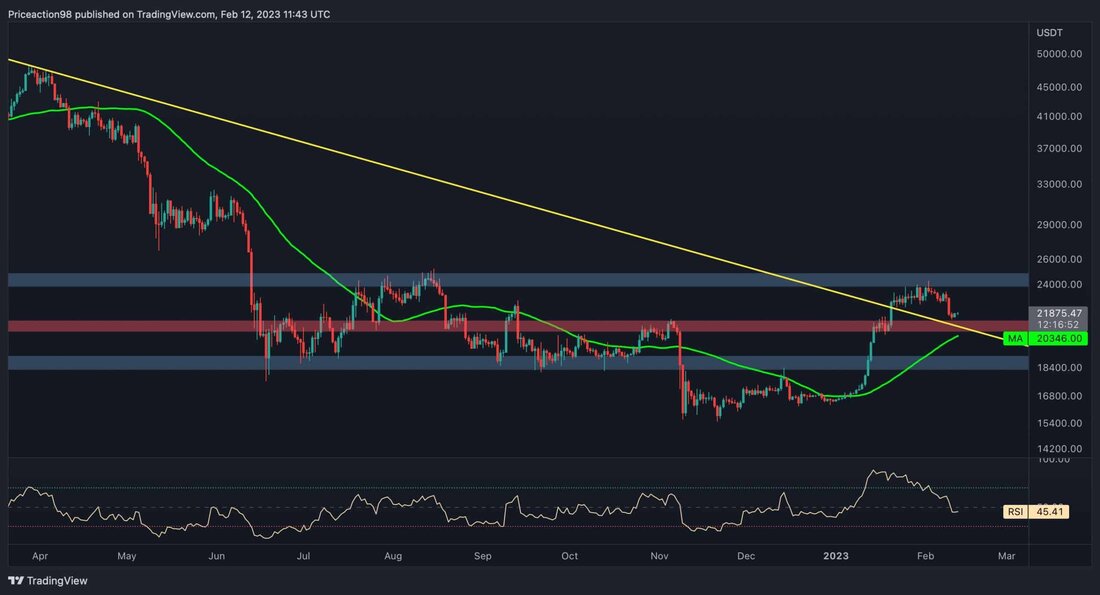

The price region of $ 25,000 has been the most important obstacle on the way of Bitcoin in the past eight months. Finally, the course tried to exceed this level and failed what led to a consolidation correction phase.

After an impulsive increase, however, a correction phase for the continuation of the rally is essential, which is usually carried out at the same time as the pullback is formed.

Therefore, the recent slump can be viewed as a correction phase to form a pullback to the vulnerable descending trend line, rinse overheated futures market positions and trigger a further increase.

Nevertheless, the price level of $ 21,000 and the sliding 50-day average, which is currently $ 20.3,000, are the primary level of support and could act next to the latest decline.

Tradingview

The 4-hour diagram

In the 4-hour time frame, the price began a slight downward movement after it was rejected by the substantial resistance region of $ 25,000 and sold sales stop orders below the small support level of $ 22.3,000.

Typically, the price tends to take a sales-stop order below the support levels during the correction phases of an upward movement before increasing.

In addition, the price has reached a significant support region after the recent break -in, which consists of the level of support of $ 21,000 and the decisive level of Fibonacci between 0.382 ($ 21,604) and 0.5 (20,785 USD).

As a result, BTC is considering considerable support and seems to start another upward movement in the coming days. Tradingview

on-chain analysis

of edris

The latest price rally from Bitcoin has made many investors believe that the bear market is finally over. Owners who have been under water in recent months are again a profit. However, there are still some warning signs because this increase could be another bull trap during the bear market.

This diagram shows the SOPR metric of the short-term owners, who measures the ratio of profits that have been achieved by the market participants who have bought their coins in the past six months. Values under one indicate losses, values over one to realized profits.

After the rally in the past few weeks, the short -term owners that BTC have accumulated at lower average prices have realized their profits.

profit -taking are not necessarily a negative sign, but this key figure has reached values that were previously achieved at the all -time high of $ 69,000. If this sales pressure does not meet demand, the correction could continue.

Cryptoquant

.

Suche

Suche

Mein Konto

Mein Konto