WWW manufacturer thinks that Krypto is similar to gambling

WWW manufacturer thinks that Krypto is similar to gambling

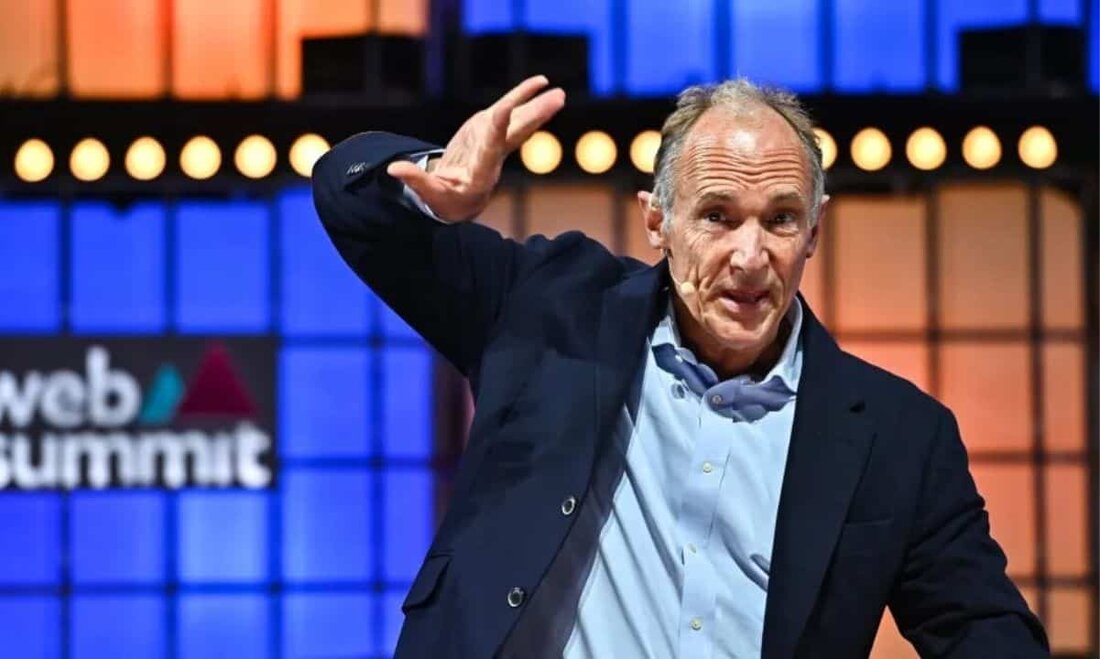

Tim Berners-Lee-the inventor of the World Wide Web (WWW)-believes that cryptocurrencies are "dangerous" and that investment in gambling is similar.

However, he argued that they could be useful for the implementation of transactions if they were converted into Fiat.

No crypto fan

In a recently published appearance on CNBC, the British computer scientist Tim Berners-Lee, who is best known for the creation of the World Wide Web, warned to keep investors away from cryptocurrencies because they are "speculative" and replicate gambling.

"To invest in certain things, which is purely speculative, is not what I want to spend my time."

He also described the crypto sector as "dangerous" and saw similarities between his current status and the dotcom bubble from the late 1990s. Numerous internet -based companies were the biggest trend at the time, and they flowed colossal capital. However, speculation was also at a high level, and many could not make a profit, which triggered a massive crash. However, some companies, including Ebay or Amazon, have survived the challenging times and are now considered giants in their field. Berners-Lee believes that the only advantage of Bitcoin and the old coins is that they can be used for transfers. Nevertheless, he advised consumers to exchange them again in Fiat currencies after receipt. Web3 has recently appeared as an allegory for the updated expansion of the World Wide Web based on blockchain technology and decentralization. The British believe that the next version of the WWW Web 3.0 should be called, which somehow differs from Web3 and would not contain such concepts. Another pronounced critic of the cryptocurrency industry, which she sees as well as Berner's Lee, is the American billionaire Charlie Munger. Warren Buffett's right hand described digital assets as gambling contracts that are neither currencies nor goods and securities. He considers it to be a serious threat to America's economic stability and wishes the government imposing a flat-rate ban on them. Finally he claims cryptocurrencies are "worthless" and "absolutely crazy, stupid gambling" options. The 99-year-old finds it "ridiculous" that someone wants to buy such assets and calls those who oppose his position, "idiots". In fact, the legacy of crypto after the countless bankruptcies, scandals and the decline in market in 2022 was severely damaged. However, the financial markets and even gold also had a hard year. Some of the main reasons for the current global monetary disorder, which captures most of the world, could be increasing inflation, military conflicts, the energy crisis and others. and while some digital assets have dubious advantages and could disappear in the future, Bitcoin seems to be able to survive the turbulence and develop as a financial asset that competes with national currencies. The dollar, the euro and many others have recently lost value, which means that with the same amount of money, fewer goods and services can be purchased today than it was years ago. In addition, central banks can print more and more Fiat or enforce guidelines that could have a negative impact on consumers. Bitcoin, on the other hand, is completely decentralized and is not controlled by governments or other institutions. It has a fixed maximum supply of 21 million coins, which causes some to classify it as a security against inflation. Although it was declared "dead" hundreds of times, it has survived earlier crises, while residents of restless nations such as Argentina, Turkey, Lebanon and others have shifted their focus on it due to their local financial problems. Selected image with the friendly approval of the FMA . Tim Berners-Lee, CNN

Charlie Munger shares a similar attitude

What is if Munger and Berners-Lee are wrong?

Kommentare (0)