Despite the Bitcoin course decline, institutional investors are increasing-market riots and fear of recession cannot shake long-term trust

Bitcoin market: Institutional investors remain optimistic despite the price drop despite the increasing unrest on the financial markets and a decline in the Bitcoin course (BTC) to less than $ 82,000, institutional investors continue to show unbroken interest. Even when the course was noted in the minus in the last seven days, spot ETFs recorded an increase in inflows, and the so-called accumulation addresses-wallets that only record purchases-are growing steadily. Trump's tariffs put the markets in fear. The decline in the Bitcoin course coincides with a general correction on the stock markets. Investors react nervously to the announcement of import duties of 25 percent by President Trump, who under ...

Despite the Bitcoin course decline, institutional investors are increasing-market riots and fear of recession cannot shake long-term trust

Bitcoin market: Institutional investors remain optimistic despite the drop in the course

Despite the increasing unrest in the financial markets and a decline in the Bitcoin course (BTC) to less than $ 82,000, institutional investors continue to show unbroken interest. Even as the course noted in the last seven days in the minus, Spot ETFs recorded an increase in inflows, and the so-called accumulation addresses-wallets that only record purchases-grow steadily.

Trump's tariffs move the markets in fear

The decline in the Bitcoin course coincides with a general correction on the stock markets. Investors react nervously to the announcement of import duties of 25 percent by President Trump, which among other things also aims to foreign cars and possibly also the pharmaceutical industry. His statement about April 2 as "Liberation Day", on which mutual tariffs are to be introduced, also stirs up uncertainty.

As a result, the S&P 500 could complete the quarter with a minus of 6.3 percent, while Nasdaq and Dow Jones record losses of 8.1 percent and 5.2 percent. For Bitcoin, this could be the weakest first quarter since 2018.falling volumes and inflation data burden the market

Another factor for the market deduction is the decline in the spot volumes and the reduced risk management of dealers at the futures markets. The current PCE inflation data was higher than expected, and consumer confidence reached a low point, according to the Conference Board.

fear of recession is increasing

Goldman Sachs has increased the likelihood of a recession from 20 percent to 35 percent within the next 12 months. The bank refers to a declining economic dynamic, a deteriorating mood in households and companies as well as signals from the White House that one is willing to accept economic pain in order to achieve political goals.

Institutional investors continue to buy

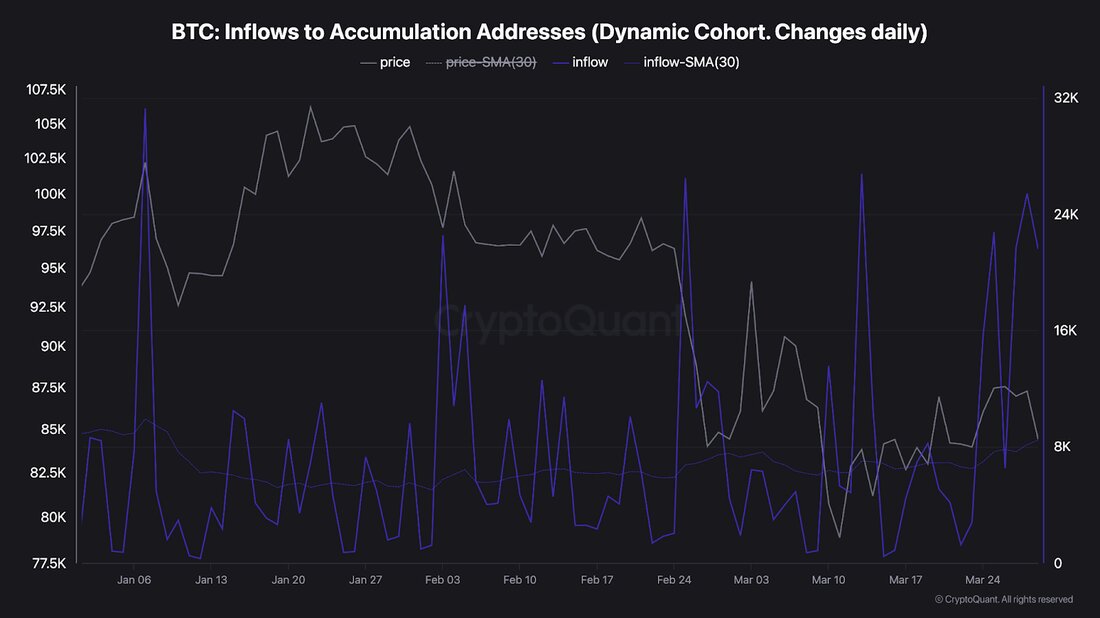

Despite the pessimistic market mood, the institutional interest in Bitcoin remains unbroken. Michael Saylor, CEO of Microstrategy, indicated new purchases on his social media channels-with the remark "Needs Even more orange". According to data from Cryptoquant, the inflows to the accumulation addresses continue to increase, which indicates that large investors take the opportunity to expand their positions.

It is striking that the long-term trust of great players in the Bitcoin market hardly seems to be shaken. While private investors withdraw and the volume drops to the futures markets, institutions have the opportunity to further increase their stocks.The Bitcoin inflow to accumulation addresses shows a positive tendency that indicates stability and trust of institutional investors.

Suche

Suche