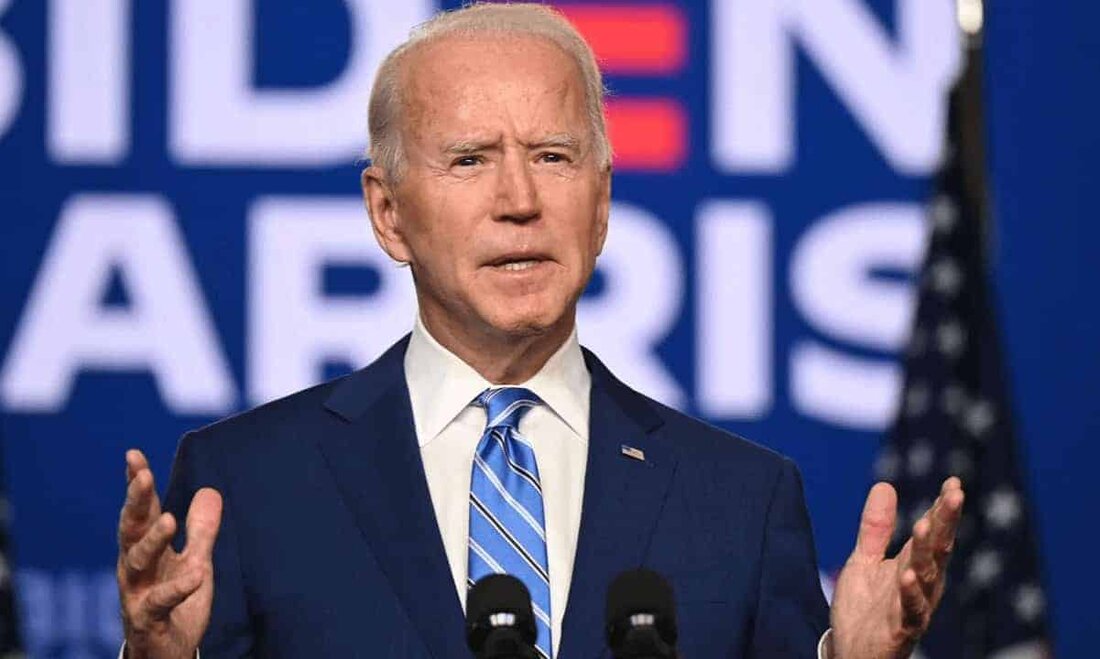

Biden calls for an end to tax loopholes that benefit wealthy crypto investors.”

US President Joe Biden is calling for an end to tax loopholes that benefit what he calls “wealthy crypto investors.” In a Twitter post late Tuesday, Biden shared an infographic that read, "We believe Congress should close tax loopholes that help wealthy crypto investors." According to the post, these loopholes have cost the government around $18 billion in revenue. In his tweet, the president mentioned “MAGA House Republicans” as opponents of his tax plans. Biden rebukes Republicans Biden explained that while he is calling for these changes, MAGA House Republicans support the tax loopholes and, in contrast, want to cut...

Biden calls for an end to tax loopholes that benefit wealthy crypto investors.”

US President Joe Biden is calling for an end to tax loopholes that benefit what he calls “wealthy crypto investors.”

In a Twitter post Late Tuesday, Biden shared an infographic that read: “We believe Congress should close tax loopholes that help wealthy crypto investors.”

According to the post, these loopholes have cost the government around $18 billion in revenue. In his tweet, the president mentioned “MAGA House Republicans” as opponents of his tax plans.

Biden rebukes Republicans

Biden explained that while he calls for these changes, MAGA House Republicans support the tax loopholes and, in contrast, favor cutting food safety inspections.

President Biden's post sparked a huge reaction from the crypto community on Twitter, with many wondering what tax loopholes he was referring to.

Joe Biden. CNBC

Adam Cochran, managing partner at Cinneamhain Ventures, which focuses on digital assets, responded to the post and said that “cryptocurrencies actually suffer compared to other assets because of how gains from transfers between asset types are taxed.” He added that he would “challenge absolutely anyone to cite this alleged loophole.”

Biden proposes changes to crypto taxation

The latest tax plan is part of Biden's recently proposed fiscal year 2024 budget plan, which has not received support from Republican opposition in the U.S. House of Representatives. The budget proposed a change to crypto taxation rules to target wash trading.

The administration noted that crypto assets were initially not subject to the same wash trading rules that apply to stocks and bonds. However, implementing these changes in this emerging asset class could result in $24 billion in revenue.

Biden's administration does not support cryptocurrencies and continues to introduce strict new tax regulations for the sector. For example, the White House Council of Economic Advisers (CEA) is calling for a punitive tax of up to 30% of the electricity costs of mining companies in the US - a move that could negatively impact these operators' profits.

.

Suche

Suche

Mein Konto

Mein Konto