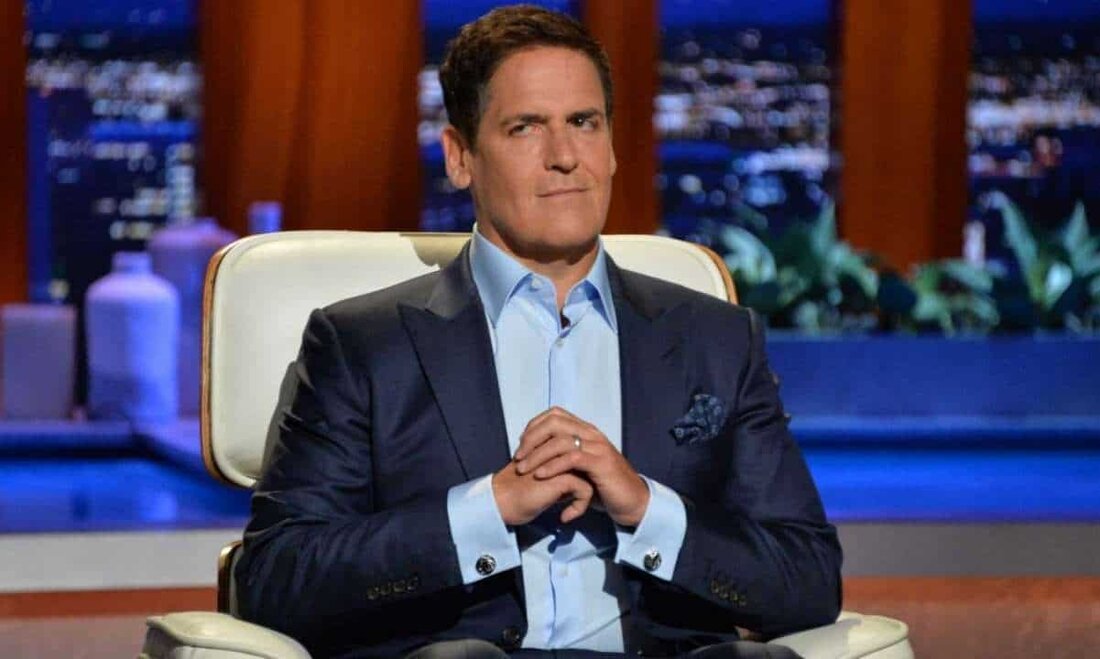

For this reason, according to Mark Cuban, 99 % of the crypto-assets will go broke.

The billion-dollar technology investor Mark Cuban led a long Twitter debate with the former officer of the Securities and Exchange Commission (Sec) John Reed Stark-a crypto skeptic who believes that the promise of blockchain has long been faded. While Cuban rejected its core arguments about the potential of the industry and the role of the Sec in it, he admitted that the vast majority of crypto tokens and blockchain companies would die. Is the regulation clear or not? The debate began on Wednesday with Stark's interpretation of the latest comments by judge Amy Berman Jackson, who is responsible for the SEC against Binance. During a hearing, the ...

For this reason, according to Mark Cuban, 99 % of the crypto-assets will go broke.

The billion-dollar technology investor Mark Cuban led a long Twitter debate with the former officer of the Securities and Exchange Commission (SEC) John Reed-a crrypto skeptic that believes that the promise of the blockchain "has long since faded" is.

While Cuban rejected its core arguments about the potential of the industry and the role of the SEC in it, he admitted that the vast majority of crypto tokens and blockchain companies would die.

is the regulation clear or not?

The debate began on Wednesday with Stark's recent comments by judge Amy Berman Jackson, who is responsible for the SEC complaint

font-weight: 400; "> During a hearing, the judge expressed skepticism compared to the approach of the SEC, problems related to the crypto industry with "test case disputes" And not to solve by determining new rules. While the crypto industry expressed a frequently cited criticism of the authority, strongly found that questions of "regulatory clarity" were "irrelevant" for the specific case of Binance.

as answer: kubaner told strongly claimed that he had "misjudged" the effects of the judge's comments. The lack of clarity in the crypto sector does not primarily affect large companies, but "the vast majority of crypto applications", which are small startups.

with all respect, my friend: https://t.co/hwreupifi0

- John Reed Stark (@johnReedstark) 14. June 2023

"If the judge says it is difficult for her to fully understand or understand the rules, she reflects what all the small start-up entrepreneurs feel if you want to follow the rules but have no clear way there," wrote Cuban.

leading companies in the crypto industry, including coinbase , argue that the SEC has not given clear guidelines for years, which crypto products Represent securities and how certain products are registered. SEC commissioner Hester Peirce is right at

, however, strongly contradicted the "lack of clarity" in cryptocurrencies and claimed that it already had "extraordinary regulatory transparency and clarity". In addition, he directly claimed that crypto tokens had no benefits beyond speculation, since they failed as a value preservation means, investment, currency or "revolutionary compensation for the" bankless ".

"Blockchain faces extraordinary obstacles to develop into the magical financial and social panacea that its sponsors have been promising for over 15 years," wrote strongly.

Most companies will die, but crypto will thrive

Cuban defended crypto because of the concrete advantages it could offer, and because of his right to develop into a more mature technology that has positive effects on the economy.

"90 percent of blockchain companies will be in place," he said. "99 percent of the tokens go bankrupt. Just like 99 percent of the first internet companies did ... but the winners will be the game changer. Technology works."

cuban added that the SEC was not intended to decide whether a technology was "valid" or not.

After he had sued Coinbase and Binance last week, second chairman Gary Gensler broadcast

"We already have a digital currency. It's called US dollar. It is called euro or yen, at the moment they are all digital. We already have digital investments, he said.

.

Suche

Suche

Mein Konto

Mein Konto