Tickenization could increase the efficiency of the capital markets: CEO from Blackrock

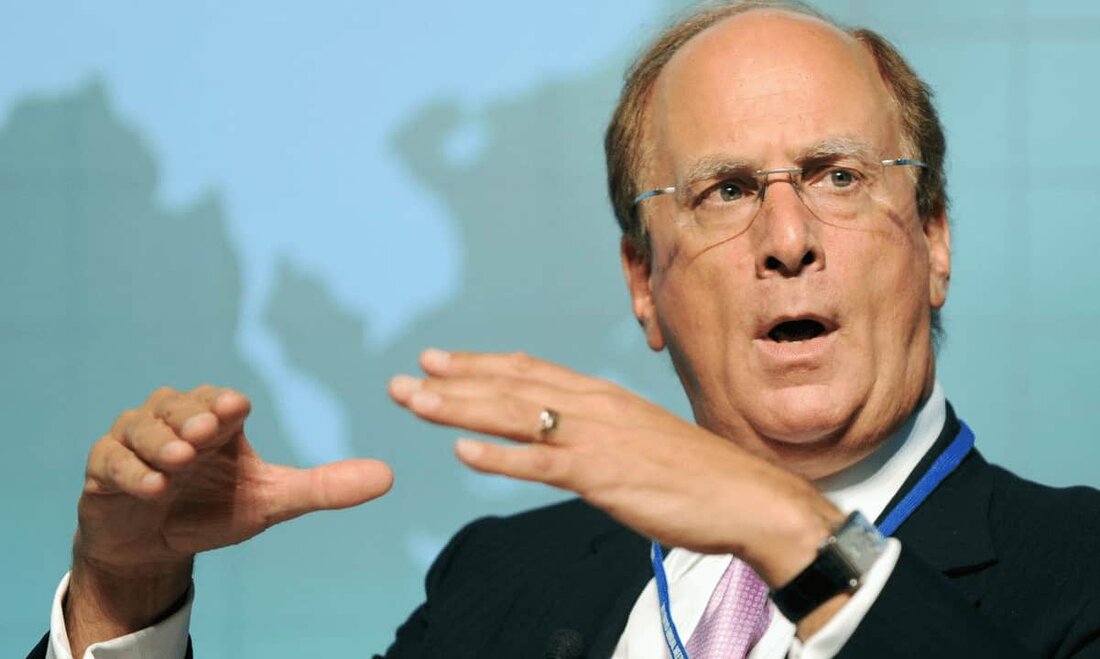

Larry Fink, Chief Executive Officer of the world's largest asset management company Blackrock, believes that the tokenization of investment classes such as stocks and bonds could promote efficiency on the capital markets and improve access for investors. In his latest annual letter to investors, the managing director notes that Blackrock is currently researching the digital asset industry and would continue to do so, especially in areas related to approved blockchains and the tokenization of stocks and bonds. Blackrock explores tokenized stocks and bonds in the letter said Fink said that the operating potential in the field of digital assets goes beyond Bitcoin. The CEO announced that in the aspiring ...

Tickenization could increase the efficiency of the capital markets: CEO from Blackrock

Larry Fink, Chief Executive Officer of the world's largest asset management company Blackrock, believes that the tokenization of investment classes such as stocks and bonds could promote efficiency on capital markets and improve access for investors.

The managing director noted in his latest annual letter to investors that Blackrock is currently researching the digital-asset industry and would continue to do so, especially in areas related to approved blockchains and the tokenization of stocks and bonds.

Blackrock explored tokenized stocks and bonds

In the letter, Fink said that the operating potential in the field of digital assets goes beyond Bitcoin. The CEO announced that fascinating developments are underway in the emerging industry beyond the hypes and the obsession of cryptocurrencies.

despite the fail from large crypto companies like FTX, digital payments are progressing quickly. Fink believes that innovative applications for the asset management industry could be created as a digital space grows .

"For the asset management industry, we believe that the operating potential of some of the underlying technologies in the area of digital assets could have exciting applications. In particular, the testing of investment classes offers the view to increase efficiency on the capital markets, shorten and improve the costs and access for investors" he.

The USA lag behind in the innovation: Fink

The CEO of Blackrock also spoke about aspiring markets such as Brazil, India and parts of Africa, which have progress in payment systems and financial inclusion. In contrast, he argued that developed markets such as the United States lag behind in the payment innovation.

"In many emerging countries - such as India, Brazil and Share Africa - we experience dramatic progress in digital payments, reduce costs and promote financial inclusion. In contrast, many developed markets, including the United States, lag behind in the innovation, which means that the costs for payments remain much higher," said Fink.

saidIn the past few weeks, the US authorities have done hard against crypto entities. From regulatory Topics with the StableCoin emission company Paxos to abrupt closure of the crypto-friendly signature bank, the US regulators have intensified their supervision of the digital assets industry.

Fink believes that the area of digital assets requires more precise regulation with increasing maturity in the industry. He indicated that clear rules would help investors to become aware of the risks associated with the sector.

.

Suche

Suche

Mein Konto

Mein Konto