Goldman Sachs recognized Bitcoin as a best performer in 2023

Goldman Sachs recognized Bitcoin as a best performer in 2023

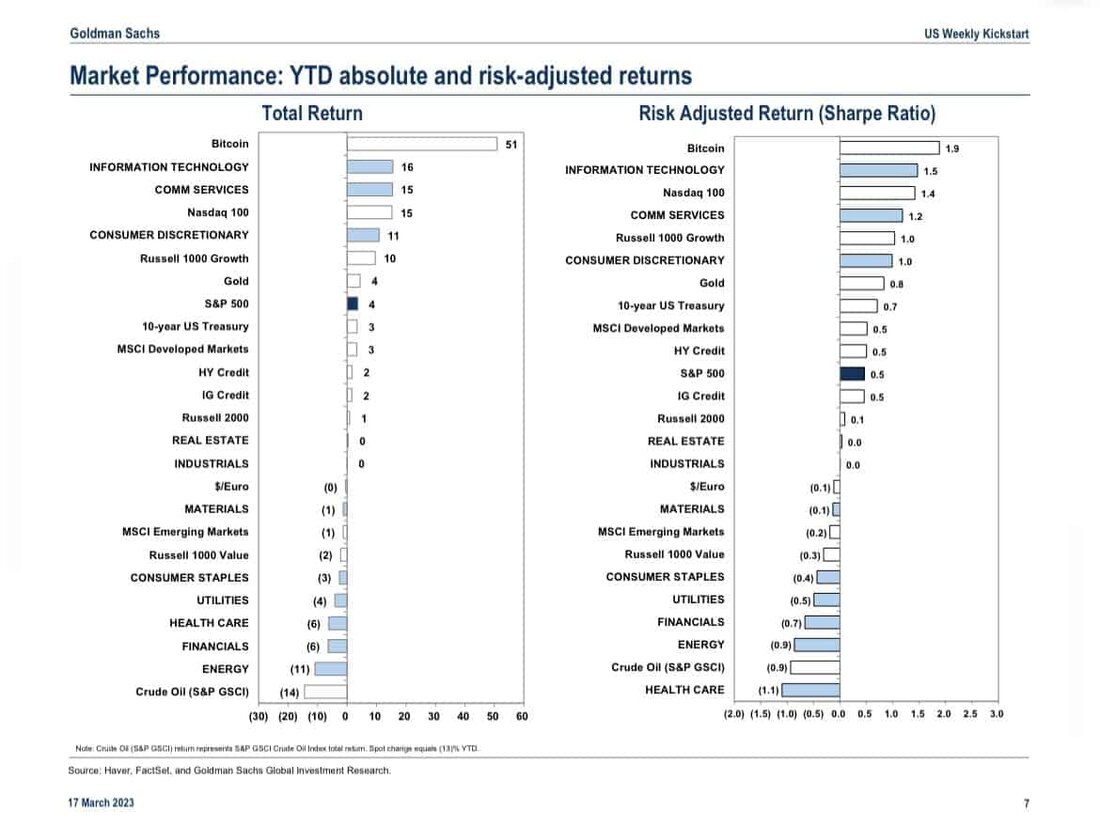

One of the leading American banks-Goldman Sachs-emphasized Bitcoin as the asset with the best performance since the beginning of the new year.

The primary cryptocurrency exceeds Nasdaq 100, Gold, S&P 500 and other investment values and sectors.

- The bank that called Potential of Bitcoin had exceeded traditional assets, precious metals and other systems in relation to the returns (YTD) since the beginning of the year.

Bitcoin performance since the beginning of the year, Twitter

- In contrast to 2022, the primary digital asset started well into the new year. Its price from $ 16.500 on January 1st at around $ 28,400 at the time of writing these lines is shot (an increase of 70 %).

- The rally made some believe that the bear market could be over and that BTC entered a new bull run. One example is Eric Peters-CEO of One River Digital Asset Management-The recently claims that the next phase will be "very powerful" because big institutions will immerse yourself.

- Ryan Selkis-CEO of the Messari crypto secret service-also outlined a favorable scenario for Bitcoin and predicted an increase in $ 100,000 in the next twelve months.

- He believes that it will act as a "rescue island and a peaceful exit option" for the adverse events in the financial world, including additional bank collapse that could occur in the near future.

- The most optimistic forecast came from the former CTO of Coinbase-Balaji Srinivasan-Who bet $ 2 million against Twitter user James Medlock that Bitcoin will be worth $ 1 million in 90 days. He believes that the expansion of the price will be due to a possible collapse of the US banking system and subsequent hyperinflation.

"I postpone $ 2 million in USDC. I will do it with Medlock and another person, which is enough to prove the point. See my next tweet. Everyone else should simply buy Bitcoin because it is much cheaper than one for 90 days," said Srinivasan.

.

Kommentare (0)