ETH faces critical resistance at $ 1.7,000, will it break this time? (Ethereum price analysis)

The cryptocurrency market experienced another bullish rally after a short -term drop in the price. Ethereum was no exception when the price increase, formed a new swing high and currently faces a significant resistance region. Technical analysis of Shayan The daily type after a short-term decline in the direction of the broken triangle pattern and the sliding 200-day average Ethereum found support and initiated an interest bully rally, which has been withdrawn to the broken level. After printing three consecutive Bullische Tagerkerken, the price reached the decisive resistance region of $ 1.7,000 and formed a higher pattern at $ 1780. This indicates that the trend is bullish. Nonetheless …

ETH faces critical resistance at $ 1.7,000, will it break this time? (Ethereum price analysis)

The cryptocurrency market experienced another bullish rally after a short -term drop in the price. Ethereum was no exception when the price rose, formed a new swing high and currently faces a significant resistance region.

technical analysis

of Shayan

the daily -type

After a short-term decline in the direction of the broken triangle pattern and the sliding 200-day average, Ethereum found support and initiated an interest bully rally, which completed the withdrawal to the broken level.

After printing three consecutive strong bullish day candles, the price reached the decisive resistance region of $ 1.7,000 and formed a higher high pattern at $ 1780. This indicates that the trend is bullish.

Nevertheless, the $ 1.7,000 region acts as a significant resistance and has rejected the price several times. If the ETH exceeds the level mentioned, an impulsive rally is imminent.

Tradingview

The 4-hour diagram

The price reversal is clearer on the 4-hour time frame chart. The decline of Ethereum was stopped after it reached the lower trend line of the rising channel at $ 1350, which led to a massive increase in price.

However, the price is currently fighting with the middle border of the canal, about $ 1640. If it falls under the trend line, ETH could be a consolidation phase with a slight drop in price.

If the price is supported on the other hand on this level, it will probably start a rally to achieve the level of $ 1.7,000.

Tradingview

on-chain analysis

of edris

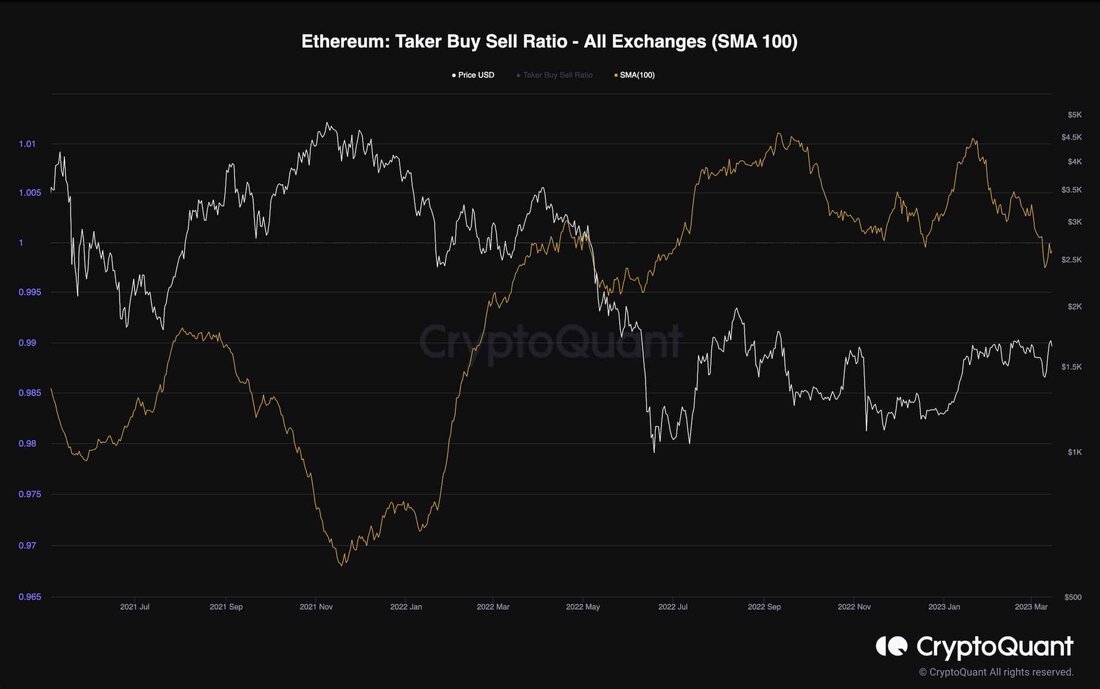

Ethereum Taker Buy Sell Ratio (SMA 100)

The Taker Buy Sell Ratio measures whether the bulls or the bears are currently performing their trades more aggressive. Values over one indicate a dominant purchase pressure, while values under 1 are associated with a negative mood.

This key figure has decreased in the past few weeks and has recently fallen below 1.

This behavior indicates that the bears are currently more aggressive and that the mood on the appointment markets has decreased, which could lead to a decline at short notice.

If the Taker-Buy-Sell ratio continues, the market could enter into another declining phase and the bear market could be extended.

Cryptoquant

.

Suche

Suche

Mein Konto

Mein Konto