Mempool almost empty: Bitcoin transaction fees fall on a minimum-danger for miners and network security?

<p> <strong> Mempool almost empty: Bitcoin transaction fees fall on a minimum-danger for miners and network security? </strong> </p>

Mempool and transaction fees in the Bitcoin world

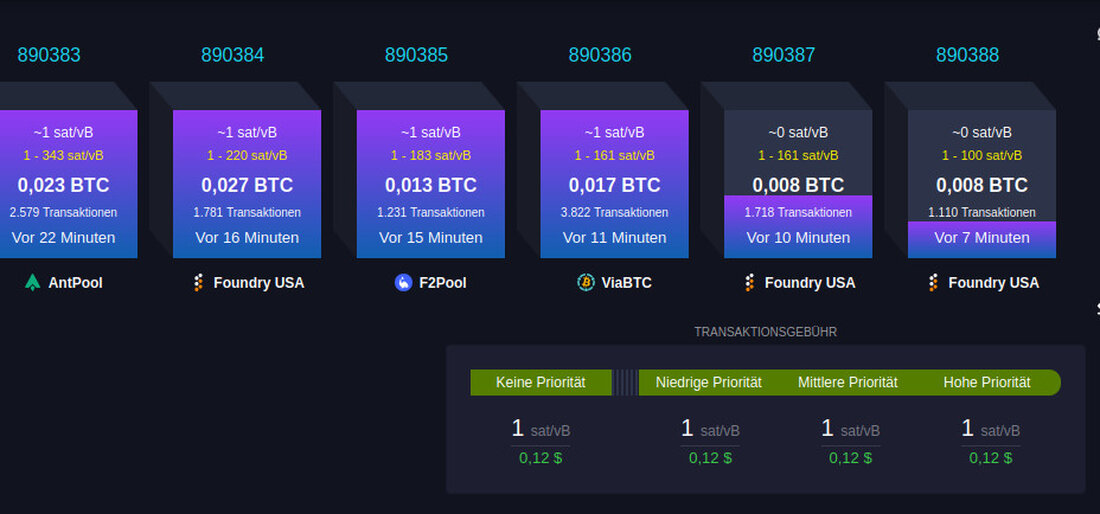

The Mempool, the memory for unconfirmed Bitcoin transactions, is currently in a remarkable condition. It is almost empty, which led to a decline in transaction fees to a minimum. This situation is an advantage for many users because they can do cost -effective transactions.

Current fee position

A fee of only 1-2 Satoshi per virtual byte is currently sufficient to get a quick confirmation of a Bitcoin transaction. This corresponds to about 10-20 cents per transaction. The main reason for this favorable fee is the almost complete reduction of unconfirmed transactions in the Mempool - a rare event that has only occurred two to three times in the past two years.

Positive effects for users, negative aspects for miner

While the low fees are gratifying for the users, this is a challenge for Miner and the Bitcoin network. An empty memorial indicates a low demand for Bitcoin transactions. This could indicate that Bitcoin is no longer used as often as a means of payment.

miner and the challenge of the income

The decline in fees has direct effects on the income of the miners. With the progress of the time and the acceptance of the subscription from the block reaward, the importance of transaction fees for miners is becoming increasingly crucial. The revenue from transaction fees has currently fallen to a minimum of around $ 261,000 - the lowest stand in one year.

Although Bitcoin's price increases in the late 2024 price losses compensate for losses, the daily overall income of the miners has not yet reached the level before the last halving. This means that the so -called "security budget", from which the miners draw on to secure the network, steadily drops.

Long -term views of the mining and safety of Bitcoin

The current trends indicate that the current bear market for this cycle would be true that the overall revenue of the miners would probably not fall temporarily but sustainably. The theory of the "fee market", which, among other things, was one of the reasons why the block size was not increased, states that a market is needed in which users compete for the limited place on the blockchain. This is the only way to increase the transaction fees to a level, the miner compensates for even if the block reavers decline.

Currently it can be seen that this theory does not become a reality. If this condition remains for the next eight to twelve years, Bitcoin's “Security Budget” could shrink dramatically. In this scenario, many mining machines could become unprofitable. In the best case, you would be closed, in the worst case this could lead to abuse in which they are used for 51 percent attacks.

FAZIT

The current situation in the Mempool and the development of transaction fees raise important questions about the future of the Bitcoin miner and the general security of the network. It remains to be seen how these factors develop over time and which solutions can be found for the challenges.

Kommentare (0)