Fed keeps Leutzins stable at 4.5 percent despite the sunken inflation number

Fed keeps Leutzins stable at 4.5 percent despite the sunken inflation number

The Fed leaves the key interest rate unchanged at 4.5 percent

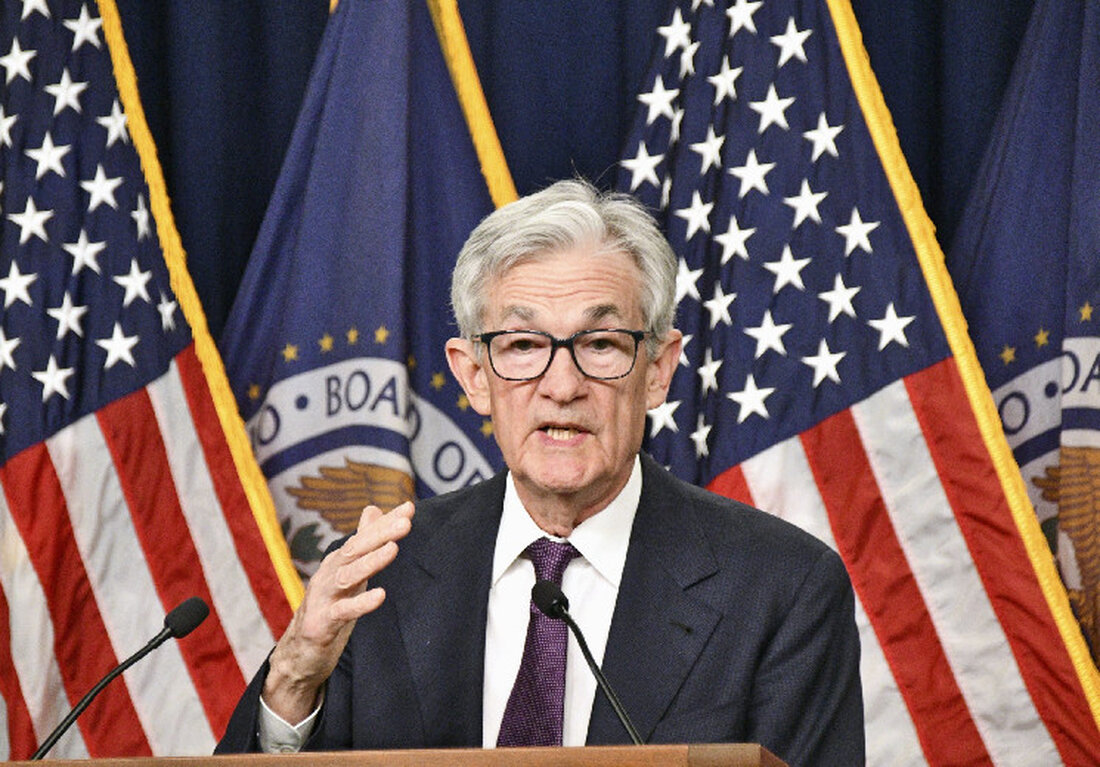

The US Federal Reserve, known as the Federal Reserve (FED), has decided not to change the key interest rate despite the recently published inflation figures of 2.8 percent in the year. The current key interest rate remains 4.5 percent.

The decision of the Fed not to turn the interest screw on shows that the central bank takes up a waiting attitude. This signals that it would still like to closely observe the economic developments and the sustainable stability of the inflation rate.

The inflation rate of 2.8 percent is a positive indicator of the economy because it indicates a moderate price increase. Nevertheless, the Fed could intend to wait for further monetary policy measures to ensure that inflation pressure does not increase again.

The maintenance of the key interest rate ensures stability in the financial system and gives both the markets and consumers time to adapt to the current economic conditions. It remains to be seen how the Fed's monetary policy decisions will affect the economy in the coming months.

Overall, the decision of the FED to leave the key interest unchanged shows a strategic consideration in a time of economic uncertainties.

Kommentare (0)