The struggle for the trust of investors: Gold trumps Bitcoin in times of the trade war

<p> <strong> The struggle for the trust of investors: Gold trumps Bitcoin in times of the trade war </strong> </p>

Commercial war and the escape to safe facilities: Gold overtakes Bitcoin

The trade war between the United States and other countries is increasing in intensity, and with it many investors flee to safe facilities. While Donald Trump is planning new tariffs, Bitcoin is increasingly getting out of the investor. Gold, on the other hand, experiences a comeback as a proven harbor in uncertain times.

Bitcoin in front of a reality check

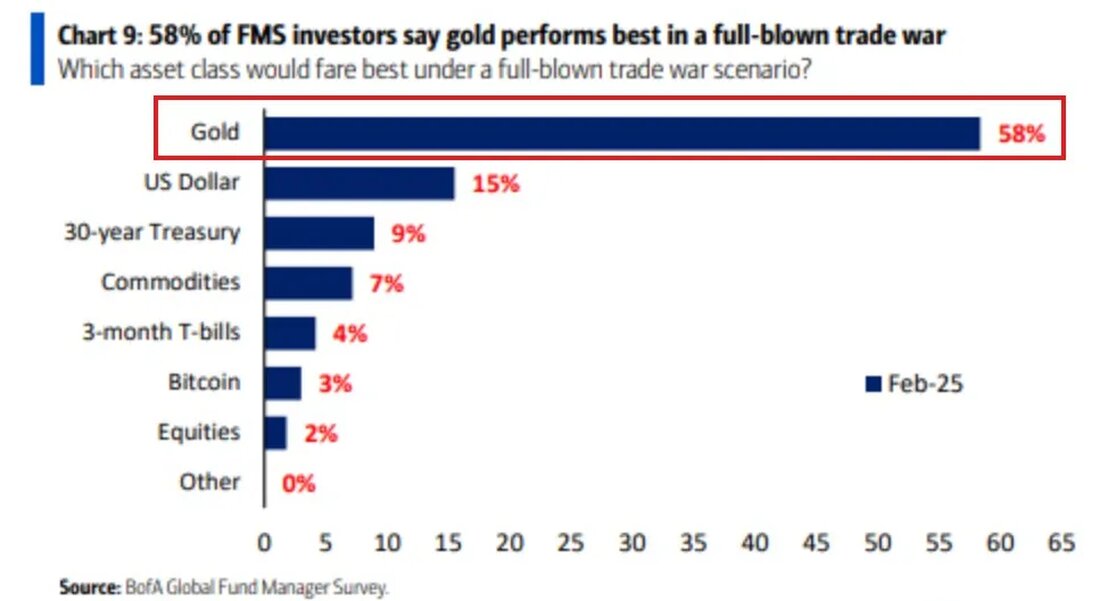

gold proves its dominance as a crisis, while Bitcoin has difficulty establishing itself as a safe harbor. This development is embedded in an environment of increasing geopolitical risks, a growing US deficit and the general uncertainty that moves investors to deduct capital. A current Bank of America survey shows that 58 percent of fund managers believe that gold is the best form of investment in times of trade wars. Only 9 percent see long-term US state bonds attractive, while just 3 percent consider Bitcoin as safe.

This survey reflects the current situation: Bitcoin, often advertised as a protective against economic instability, has difficulty gaining the institutional crypto investors in the volatile macroeconomic environment of 2025. Long-term US state bonds and the US dollar also lose attractiveness, since trade wars and fiscal dysfunctions shake confidence in the markets. The US deficit, which is now estimated over 1.8 trillion USD, also undermines trust in traditional safe ports.

obstacles to the institutional crypto adoption

Despite the limited offer and decentralization, the short -term volatility of Bitcoin remains a great obstacle to institutional acceptance as a safe port. While some dealers consider Bitcoin to be a long -term value preservative, it lacks immediate liquidity and risk -averse attractiveness that offers gold in times of crisis.

Current political developments also allow the volatility of the markets to be expected. President Trump is expected to announce extensive new tariffs at the so -called “Liberation Day”. Experts warn that this could potentially trigger extreme market volatility.

In the past, trade conflicts have led to investors fled to secure facilities. With the upcoming announcement, investors position themselves forward -looking and prefer gold Bitcoin.

gold is increasingly not only seen as protection against inflation, but also against geopolitical risks and fiscal dysfunction. Traders notice that the traditional strategies have to be covered. In view of the growing economic challenges, gold could be the only politically neutral value memory that remains.

FAZIT

Despite the current challenges, Bitcoins remains long -term narrative. The global reserve currency system is changing, the US debt problems are increasing and monetary policy continues to change. The promise of Bitcoin as a censor resistant and limitless investment remains relevant.

At short notice, however, gold leads the list of crisis insurers due to its lower volatility and broad institutional acceptance. For Bitcoin enthusiasts, the question remains open whether and when Bitcoin is accepted as a serious alternative to gold. Until then, Gold remains the clear favorite in times of economic uncertainty, while Bitcoin continues to try to prove his place in the upcoming financial paradigm shift.

Kommentare (0)