Bitcoin course under pressure: increase in the whale signals potential market wages despite the bearish trends

<p> <strong> Bitcoin course under pressure: increase in the whale signals potential market wages despite the bearish trends </strong> </p>

Current developments in Bitcoin (BTC): Markt update and technical analysis

Bitcoin (BTC) has been traded under the 90,000 USD brand since March 7, 2023. The crypto market is currently showing signs of a changed mood, but Bitcoin continues to fight to win upwards dynamics again. Despite a potential setback, technical indicators such as the Ichimoku cloud and the EMA lines indicate that the trend remains bearish.

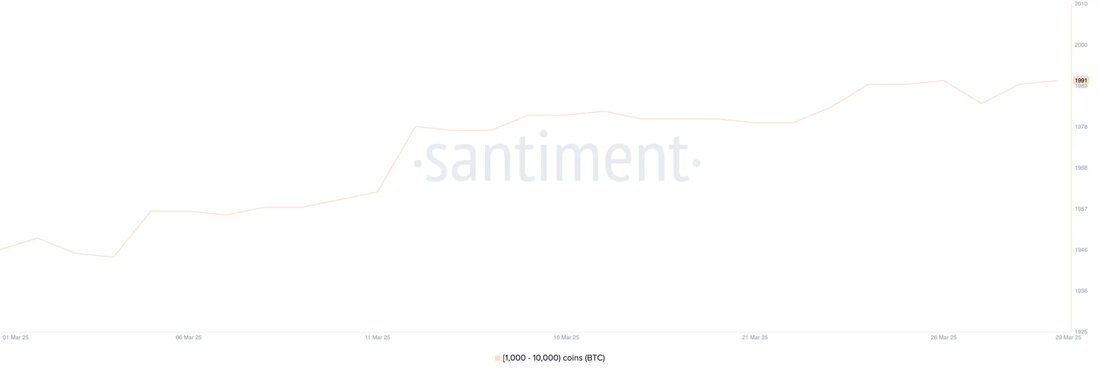

increase in Bitcoin whales on a 3-month high

In the past few weeks, the number of Bitcoin whales-wallet has increased-stimulously increased. On March 22, 2023, there were 1,980 such addresses, and this number has now risen to 1,991. Even if this increase may seem modest at first glance, it represents a significant increase in the large-scale accumulation and has been the highest number of Bitcoin whales for more than three months.

The observation of these wal addresses is crucial because large owners are often able to influence price movements. An increase in Bitcoin whales can indicate growing trust in institutional investors and wealthy private individuals. If more whale accumulate BTC instead of selling, this is often interpreted as a sign of a bullish atmosphere and reduced sales pressure. With the current number of whales at a multi-month high, this could indicate that important actors position themselves before a potential upward movement of the Bitcoin course.

btc ichimoku cloud indicates challenges

The Ichimoku cloud chart for Bitcoin shows that the course is consolidated just below the Kijun-Sen (red line) after a strong downward movement. The Tenkan-Sen (blue line) is still under the Kijun-Sen, which indicates short-term bear dynamics. Although the course is trying to stabilize, it has not yet shown a decisive trend reversal. The Lagging Span (green line) positions itself under the course and the cloud, which increases a bearish outlook from a historical point of view.

The structure of the Ichimoku cloud is currently bearish, with the Senkou Span a (green cloud border) below the Senkou Span B (red cloud limit). This cloud projects downwards and indicates resistance in the upper region and a limited bullish dynamic, unless the course can break the cloud decisively. In addition, the thin structure of the cloud shows a possible vulnerability; If buyers intervene with strength, a window could open to reversal. At the moment, however, the predominant trend according to the IMOKU principles remains Bärisch.

Bicycle BTC course: Is the 88,000 USD brand possible?

The Bitcoin EMA lines continue to point out a downward trend, with short-term sliding average lying below the longer-term. This structure indicates that the bear dynamics remains predominant. However, if the buyers succeed in regaining control and establishing an upward trend, the Bitcoin course could increase towards important resistance levels.

The first challenge was around $ 85,124. A breakthrough over this level could pave the way to $ 87,482 and possibly up to $ 88,839, provided that the bullish dynamic continues. Otherwise, the failure to build up an upward movement could increase the current bear structure. In this scenario, Bitcoin could again test the level of support at around $ 81,187, and a breakthrough underneath would further confirm the downward trend, which could possibly push the course to $ 79,955.

In view of these developments, it remains important to observe the market movements and technical indicators in order to better assess the future price development of Bitcoin.

Kommentare (0)