Bitcoin in the first quarter of 2025: worst quarterly returns in seven years - a look at market trends and future developments

<p> <strong> Bitcoin in the first quarter of 2025: worst quarterly returns in seven years - a look at market trends and future developments </strong> </p>

Bitcoin (BTC): A difficult start to 2025

Bitcoin (BTC) experienced a challenging start in the first quarter of 2025, with the lowest quarter returns in seven years. This significant acceptance has unsettled many investors and made them ask themselves whether the optimal time for purchases or sales is now.

Bitcoin course in the 1st quarter: a 7-year low

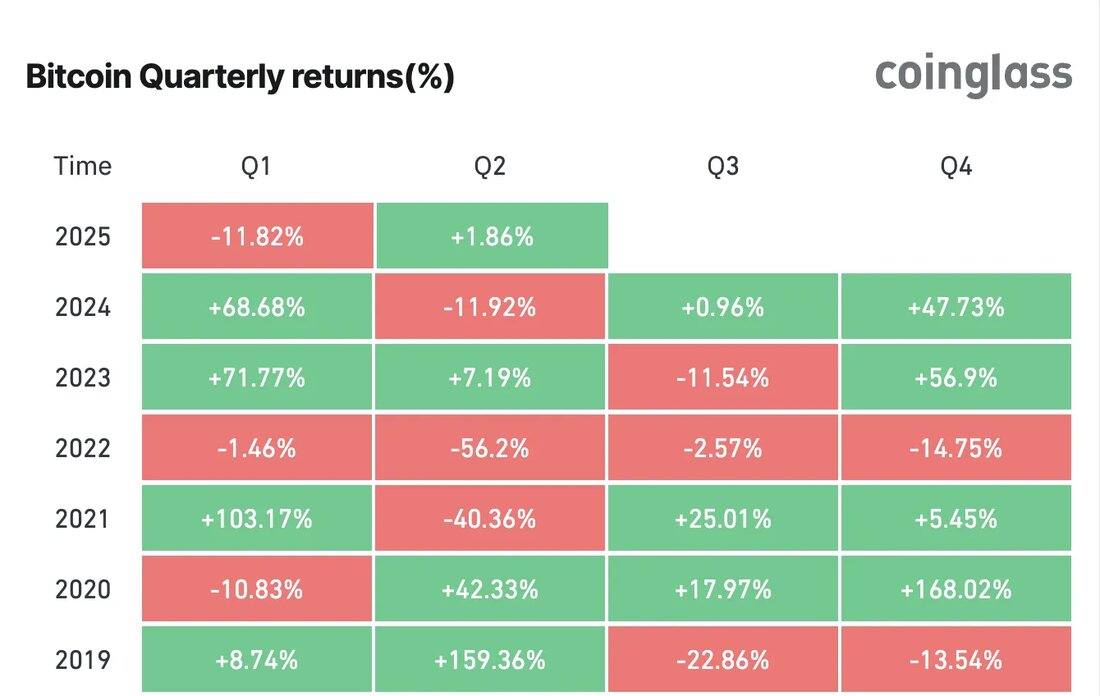

Bitcoin recorded a decline of 11.82 percent in the first quarter of 2025, which has been the weakest performance since 2018. For comparison: 2018 was characterized by a brutally running bear market, in which BTC lost over 50 percent of its value. While Bitcoin recorded an increase of more than 68 percent in the first quarter of 2024, the course fell from $ 106,000 to around $ 80,200 between December 2024 and March 31, 2025. This decline is due to a combination of macroeconomic pressure and political uncertainties, especially with regard to the new customs policy of US President Donald Trump.

Despite this bearish environment, on-chain data show a different trend: Bitcoin whales continue to accumulate BTC. A Santiment report of March 31, 2025 found that the number of whale addresses that hold between 1,000 and 10,000 BTC has reached a maximum of 1,993 since December 2024. This corresponds to an increase of 2.6 percent in the past five weeks, which indicates growing trust among large owners.

On March 31, 2025, Glassnode also reported that commercial activity among Bitcoin owners with a holding time of 3 to 6 months has fallen to the lowest level since June 2021. This development indicates that short -term owners either remain stable or leave the market, which reduces sales pressure. According to the Glassnode, BTC owners' expenses have been on the lowest level since mid-2021, which underpins that the youngest buyers keep their positions.

In addition, the Bitcoin stock of stock exchanges fell to 7.53 percent on the same day, the lowest level since February 2018. A low inventory of stock exchanges often correlates with long-term holding behavior, which can lead to a scarcity that increases prices in the future. These metrics indicate that Bitcoin could enter into a phase of accumulation and consolidation. On April 1, 2025,Market analyst Axel Adler Jr. expressed the assessment that Bitcoin's sales pressure was exhausted and predicted a consolidation phase in April and May. This suggests that the market could stabilize before taking its next important step.

fidelity research sees signs that Bitcoin gains momentum for the next phase of his "acceleration phase". The analysis of Fidelity is based on historical cycles that indicate that consolidation phases often precede large price increases. These observations agree with the trend of the WAL accumulation and the declining stock exchange stock and could indicate a potential upward moment in medium to long period of time.

Kommentare (0)