Bitcoin recovers: optimism returns while long -term investors keep their coins

Bitcoin recovers: optimism returns while long -term investors keep their coins

Optimism for Bitcoin: Market movements and trends examined

Bitcoin recently went through a challenging phase, in which the price fell to a preliminary low of $ 76,700. In the meantime, however, the course has experienced a significant recovery and has increased by almost $ 10,000. The blockchain analysis company Glassnode reports that optimism returns to the market. Especially long -term investors who have been holding their Bitcoin for more than 155 days show again.

Positive signals for the Bitcoin course

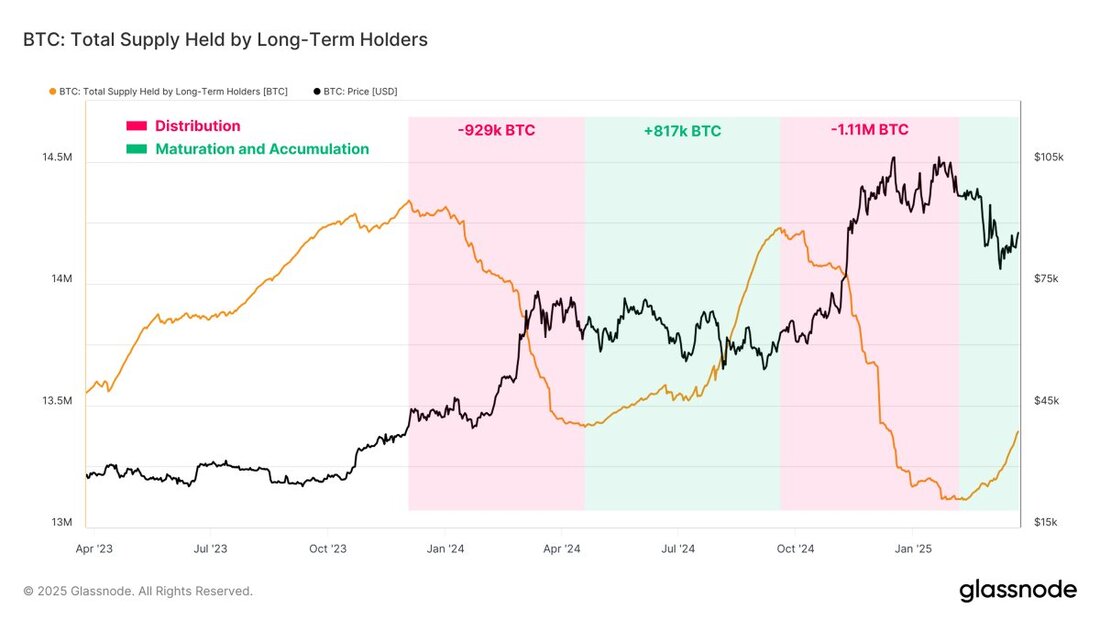

According to the analysts of Glassnode, this is a positive signal for the Bitcoin course. Bitcoin owners sold between 2023 and 2025 over two million Bitcoin in two different waves. However, each wave of sales was followed by a strong recording process, which helped to absorb sales pressure and create a cyclical balance. This could contribute to stabilizing the price.

In addition, investors who have not yet reached the 155-day mark show that they have been investing for three to six months, an increasing willingness to keep their coins. This group, which is almost a long -term owner, has significantly increased its assets. Many of these coins were acquired near the all -time high, and their adherence to these positions is a sign of conviction and not for surrender.

stagnating sales behavior for new investors

Glassnode emphasizes that the sales behavior of investors who have been holding their Bitcoin for three to six months has been at the lowest level since mid -2021. This inactivity indicates that investors who have recently entered the market do not sell their positions despite the market volatility.

Currently the Bitcoin course is $ 84,780, which indicates a new, slightly positive momentum. However, it remains to be seen whether Bitcoin can maintain this positive development, since the general investment climate is currently characterized by uncertainties. In particular, Donald Trump's trade policy and the tense situation of the US economy ensure concern. If there is a recession in the United States, another phase of a bull market for Bitcoin would be extremely unlikely.

Overall, the current market situation shows that there is permanent conviction among the investors that could have a positive effect on the Bitcoin course. Nevertheless, uncertainty about economic developments remains an important factor that will significantly influence the future of Bitcoin.

Kommentare (0)