US exchange supervision SEC Ebnet Weg for Altcoin-ETFS: Clear rules for Proof-of-Work-Cryptoassets could fuel the ETF boom

<p> <strong> US exchange supervision SEC Ebnet Weg for Altcoin-ETFS: Clear rules for Proof-of-Work-Cryptoassets could fuel the ETF boom </strong> </p>

US stock exchange supervision SEC paves the way for Altcoin-ETFs: A new era in the crypto market

The US stock exchange supervision SEC has taken a significant step that has the potential to significantly change the landscape of the crypto market. In a current press release, it was decided that proof-of work cryptoassets, such as Litecoin and Monero, are not considered securities under US law. This leads to clear regulatory guidelines and could result in a boom at Altcoin ETFs.

sec laid the foundation for the approval of further ETFs

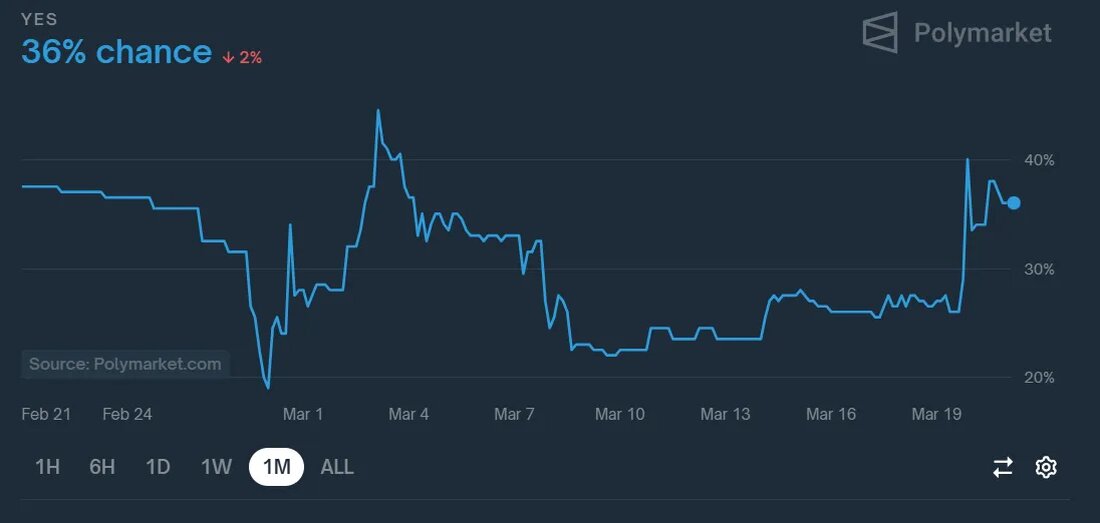

The SEC has explained that mining activities do not affect the sales process for securities and therefore participants in these activities are not obliged to register transactions to the Commission. This regulatory clarity could facilitate the approval of ETFs for certain proof-of-work (POW) cryptoassets. Litecoin, which falls under this category, already had a good chance of approval.

The decision could also lead to more asset managers offer ETFs for other Pow coins such as Monero or Kaspa. Interestingly, this trend is not only limited to Pow assets. As early as February, the SEC decided that memo coins, including Dogecoin, do not represent securities what potential obstacles for Dogecoin ETFs.

sec and the future of ETF applications

The SEC could further influence the regulatory landscape by classifying various assets as non-securities. This course could significantly increase the opportunities for future ETF applications, even if this means that some decision-makers in the Commission such as Caroline Crenshaw express concerns. In the past, Clenshaw has criticized the argumentation of the SEC regarding crypto classifications and pointed out possible loopholes.

Despite these internal differences within the SEC, it is expected that a nomination hearing for Paul Atkins, Trump's candidate for the SEC chair, will soon take place. Atkins could drive approval for a variety of altcoin ETFs, since other commissioners already stimulate the discussion about the distinction between securities and raw materials.

FAZIT

The current developments show that the SEC strives to clarify and modernize the regulatory framework for the crypto market. With the opening for Altcoin ETFs and the possible approval for asset managers who want to invest in further Pow coins, the industry is facing potential growth. Analysts, such as those of BeinCrypto, predict the approval of several altcoin ETFs by the 2nd quarter of 2025, which could further drive the institutionalization of the crypto market. The coming months could be decisive for how the regulatory framework develops and how they affect the market.

Kommentare (0)