rebranding from EOS to Vaulta: Altcoin course jumps by almost 20 percent-developments in web3 banking in the focus

EOS (EOS) Course analysis: Stabilization and future prospects after Rebranding The Layer 1 Blockchain project EOS (EOS) shows remarkable course development in the course of a planned rebranding under the new name Vaulta. EOS currently leads the list of top 100 old coins in a week comparison with an increase in value of almost 20 percent. The course has moved north from a low point of $ 0.43 to a currently $ 0.69, which corresponds to an increase of almost 60 percent. The aim of offering new product strategy and perspectives Vaulta has set itself the goal of offering new banking services in the web3 area, whereby the focus is on asset management, payment processing, investments and insurance companies. This product strategy already seems to be successful ...

<p> <strong> rebranding from EOS to Vaulta: Altcoin course jumps by almost 20 percent-developments in web3 banking in the focus </strong> </p>

EOS (EOS) Course analysis: Stabilization and future prospects according to rebranding

The Layer 1 Blockchain project EOS (EOS) shows a remarkable course development in the course of a planned rebranding under the new name Vaulta. EOS currently leads the list of top 100 old coins in a week comparison with an increase in value of almost 20 percent. The course has moved north from a low point of $ 0.43 to a currently $ 0.69, which corresponds to an increase of almost 60 percent

New product strategy and perspectives

Vaulta has set itself the goal of offering new banking services in the web3 area, whereby the focus is on asset management, payment processing, investments and insurance companies. This product strategy already seems to show initial successes, which has a positive effect on the EOS course.

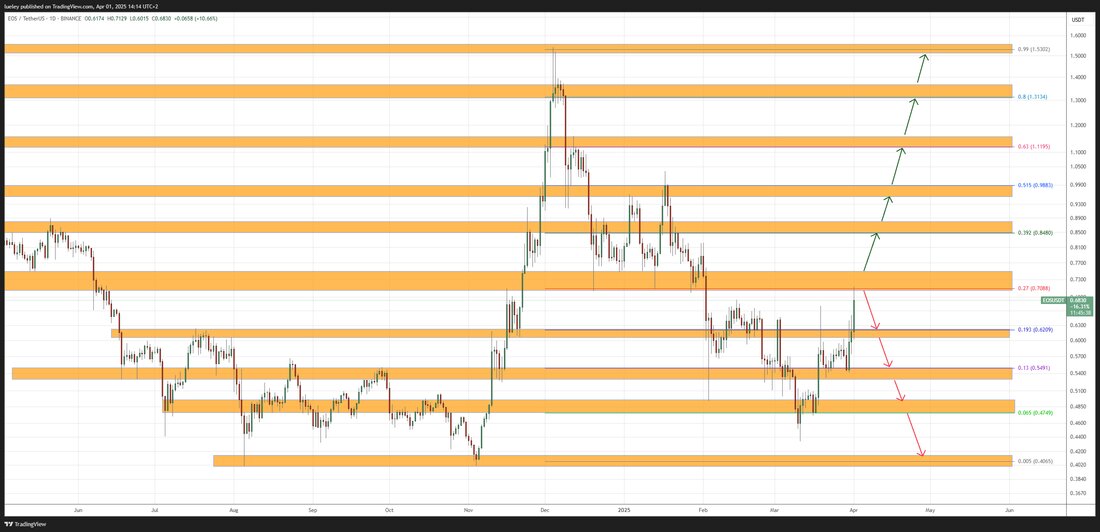

In the coming days, the crypto market could continue to recover. If this is the case, EOS could reach the $ 0.75 mark at short notice. If the buyer side manages to overcome this resistance level sustainably, we could observe a bullish movement movement towards the next target zone at $ 0.86.

keep possible price movements

A breakthrough over the $ 0.86 brand could pave the way for an increase to the annual high of $ 0.98. However, it can be expected that profit -taking could occur here. Only when EOS can break through this important target area by a daily closing course does the probability that we will continue to increase at $ 1.15 in the direction of the intermediate high.

If EOS should also overcome this resistance, the next price target would be reached at $ 1.35. This brand could not be overcome last December at the end of the day, but a price increase would be possible until the previous year of $ 1.53. Until further notice, this course brand remains relevant as the maximum goal on the top.

Risks and correction potential

However, EOS does not succeed in stabilizing the price of $ 0.71 and if it drops instead, the zone could once again be targeted by the current daily low at $ 0.61. If the course broke down this support brand sustainably, a retest of the support zone must be planned at $ 0.55, where it is likely that the buyer side will try to stabilize the course.Another decline below the $ 0.55 mark could even result in a test of the support area by $ 0.48. Should the EOS course also react weakly at this point and continue to fall more dynamically, a relapse to the previous year's low at $ 0.40 would not be ruled out.

FAZIT

The course development of EOS (Vaulta) is under the influence of a planned rebranding and an innovative product strategy in the web3 area. While the current trend is pointing up, investors also have to keep an eye on potential reset. The course of the course remains exciting and it will be interesting to observe whether EOS is able to overcome the resistances and make sustainable profits.

Suche

Suche

Mein Konto

Mein Konto