The rise of the stable coins: Is a new season in the crypto market begun?

The evolution of the stablecoins in the cryptomarkt crypto market has changed from the prevailing altcoin era into a phase that is shaped by a significant expansion of stable coins. The total value of the stable coins has now exceeded the 230 billion USD brand and reaches new highs almost every week. This development is not only due to the increase in leading stable coins such as Tether (USDT) and USD Coin (USDC), but also to numerous new introductions of smaller stable coins. Changpeng 'Cz' Zhao, the founder of Binance, found that the number of new StableCoin startups has been exceeding the old coins lately. More and more founders are opting for models with synthetic ...

<p> <strong> The rise of the stable coins: Is a new season in the crypto market begun? </strong> </p>

The evolution of the stable coins in the cryptom market

crypto projects have changed from the prevailing Altcoin era into a phase that is characterized by a significant expansion of stablecoins. The total value of the stable coins has now exceeded the 230 billion USD brand and reaches new highs almost every week. This development is not only due to the increase in leading stable coins such as Tether (USDT) and USD Coin (USDC), but also to numerous new introductions of smaller stable coins.

Changpeng 'Cz' Zhao, the founder of Binance, found that the number of new StableCoin startups has been exceeding the old coins lately. More and more founders are opting for models with synthetic or assets supported by assets to increase their liquidity. Zhao noticed: "I see more stablecoin startups than Alts."

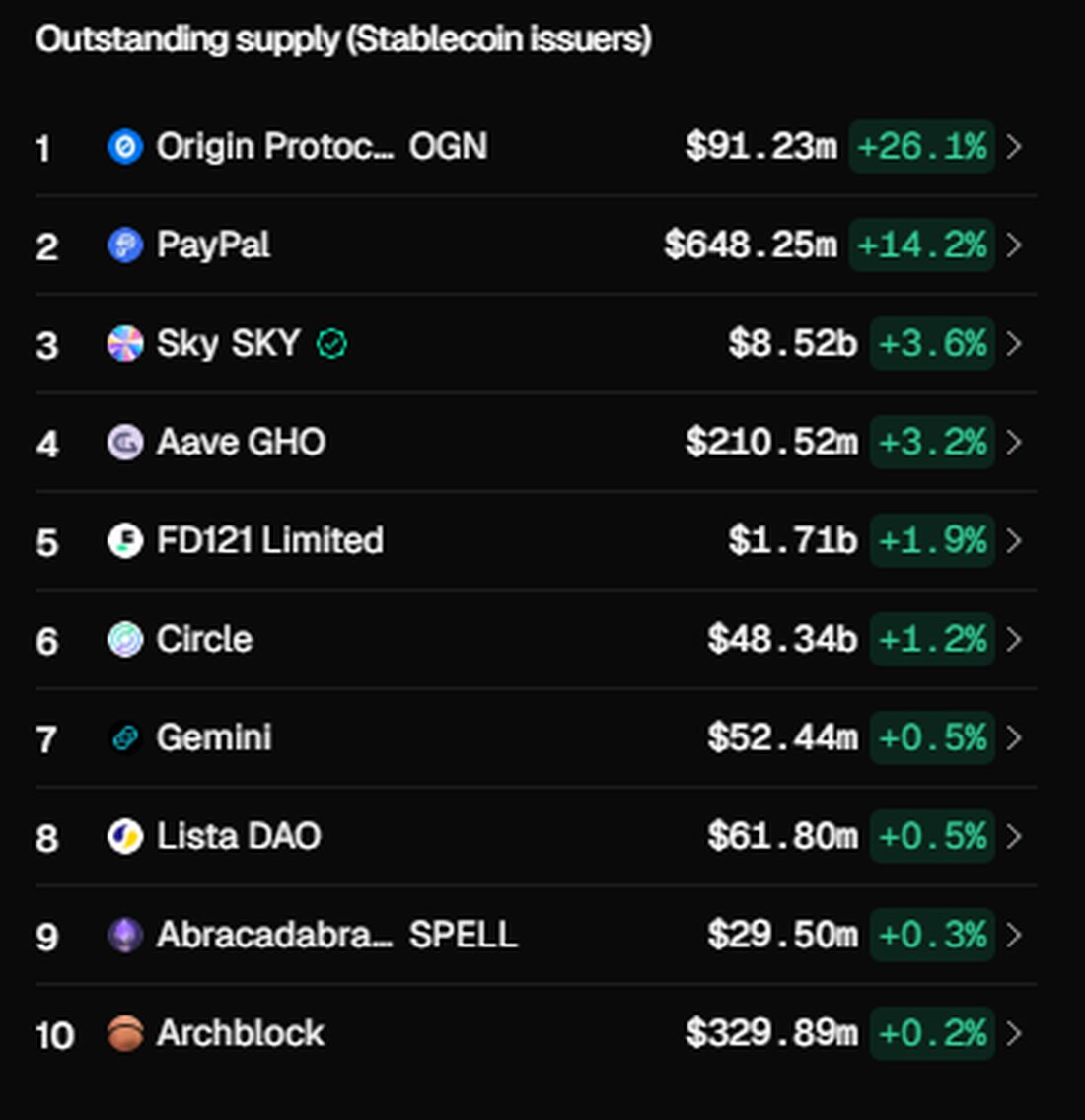

The exact supply of the leading and smaller stable coins fluctuates depending on the latest market launches. The overall rating of the stable coins is currently estimated to be between 229.4 and 236 billion, with over $ 200 billion on USDT and USDC alone. Binance has also introduced FDUSD, a centrally controlled stable coin that serves the liquidity into several leading trading pairs.

The rise of smaller stable coins

stablecoins can be divided into three categories: the market leader USDT and USDC, large stable coins such as Dai and Usde, which are associated with defi protocols (decentralized financing), as well as numerous new assets that have relatively low liquidity. A possible "stable coin season" could promote the use of existing assets and the development of new stable coins with a wide range of applications.

Despite a flood of old coins and tokens that flood the market, there are already 42 smaller stable coin projects with a total value of $ 6.4 billion. These projects show that the new wave of smaller stable coins has almost constant creation, while the entire list of stable coins counts up to 300 different assets. Many of these smaller projects could benefit from the general recovery of the cryptom market.

risks and challenges

It is important to note that not all stable coins are equivalent. At the moment, about 10.9 billion USD are bound in over -secured coins, which is a risk, especially if the cryptoma market moves into a downward trend. Algorithmic stable coins that are the most risky category have an offer of only $ 800 million for Ethereum. These uncertainties were reinforced by the experience with Terra (Luna), where protocols used their own stable coins to manipulate the assets.

Another serious problem concerns the fragmented liquidity in the StableCoin world. New stable coins often create isolated ecosystems, which makes trade and interoperability difficult between these projects. Some act more like bonds and require years of bonds before a nominal value is achieved. A possible stable coin season could still be risks for investors, even if the tokens are nominal at 1 USD.

influence of the USD on the cryptom market

StableCoins have effectively coupled the crypto market to the US dollar. Chinese media recently pointed out a spillover effect in which the risks and debts of the US dollar could influence the cryptoma market. They called for a stronger localization of the market, possibly by introducing RMB stable. These currently only have a reported offer of $ 2.9 million, which is similar to limited pressure as stable coins in euros. Usdt, especially in tron-based applications, remains the most frequently used stable coin in the Asian market.

Overall, the development in the StableCoin sector shows that these digital currencies are becoming increasingly important. A better understanding of their dynamics and risks will be essential for investors and market participants in order to be able to use the associated opportunities effectively.

Suche

Suche